Irakli Kakhidze

Director of Turnkey

About the author

Seasoned professional with a strong background in product leadership and management. With over 5 years of experience in various management positions, Irakli has a proven track record of success in delivering high-quality projects and driving teams towards excellence.

Home to a young and fast-growing consumer market, Africa is an attractive location for iGaming expansion. At VeliTech, we learned this by helping one of our clients launch their online betting brand in Africa. An 8x increase in GGR and a 3x rise in unique active players in just 6 months proved the potential of this emerging market and the efficiency of our turnkey solution.

Empowering the development of VeliHorizon and VeliGames, my team and I gained valuable insights about the region. I am happy to share what we learnt along the way: why the region is such an attractive destination for gambling brands, the challenges you need to be aware of, and most importantly, the steps to take for a successful iGaming market entry in Africa.

What makes Africa an emerging iGaming market?

Well, first, it’s essential to mention that when we talk about Africa, we mean 54 countries, each unique in its own way, with each representing a distinct opportunity. Through our journey with PLAYONGO, a leading company in sports betting and casino, we learnt that the ability to understand and adapt to varied contexts across the continent not only broadens growth potential but also allows you to enter markets at the very beginning of their emergence.

So, how is it that Africa, with all its diversity, is becoming increasingly attractive for iGaming brands?

Gradual penetration of technology

From what we saw, Africa started taking confident steps towards adopting global technologies. The mobile technology boom, the rise of digital wallets, and the improved quality of internet connectivity — these facts have all created a new wave of interest in digital entertainment options, including online betting and casino games.

But since many countries in the region are still at the beginning of their journey, it’s smart to make the most of this moment and launch your iGaming business in Africa now. That way, by the time African online gaming becomes mainstream, you’ll already have a strong presence in the market.

Young population

The average age in Africa is 19.2 years, making it the youngest region in the world. And we can confidently say that African youth are eager for iGaming. Not only from our experience, but statistically as well: a survey by Infoquest, a South African research company, revealed that 139 out of 300 surveyed online gamblers were aged between 18 and 39.

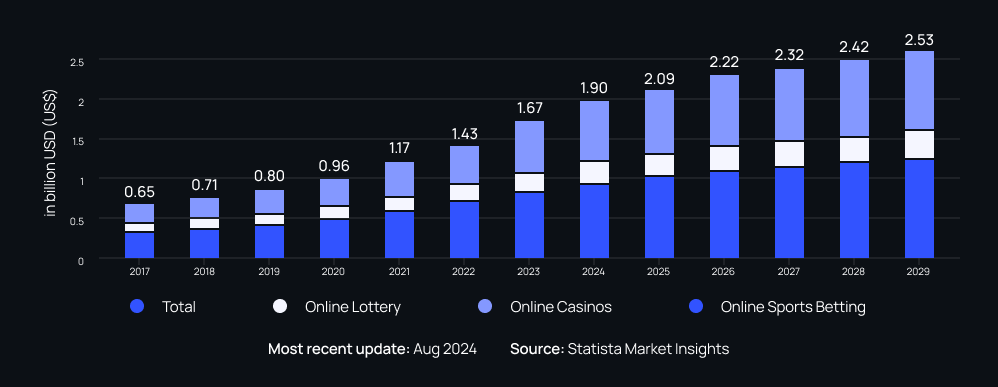

Market growth

Statista predicts that the African online gambling market will reach US$1.90bn in 2024 and rise even further to US$2.52bn by 2029, representing a healthy CAGR of 5.81%. Moreover, research suggests that the expected number of users by 2029 will be 14.1 million, which gives you, as an iGaming business, a lot to think about.

Needless to say, the African region shows a lot of promise for iGaming businesses in 2025. However, to launch an online betting brand in Africa that achieves success, you need to be aware of the challenges — the same obstacles we faced when entering the African market with PLAYONGO.

What are the challenges of the African online gaming market?

Once PLAYONGO reached out to our team, both of us were new to the African iGaming market. The client had a strong track record in Europe and aimed to achieve similar success in Africa. Little did we know back then, that it would be a tough journey, requiring extensive research and careful adjustments. Here’s where the challenges began.

Limited digital accessibility and high internet costs

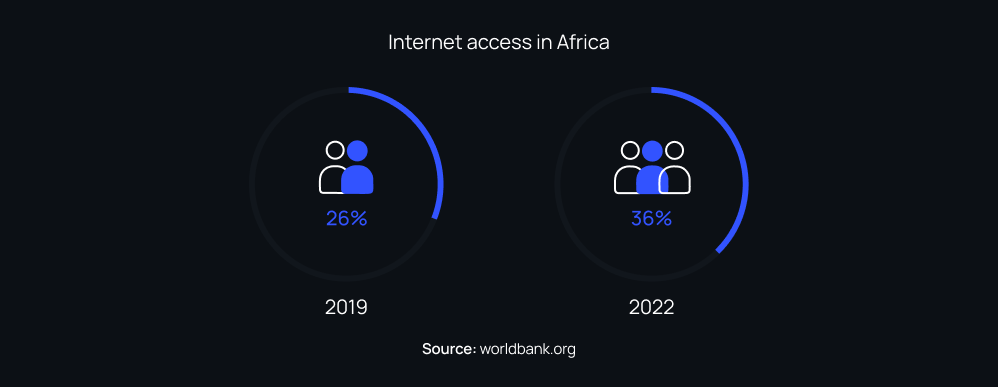

Although access to broadband internet in Africa increased from 26% in 2019 to 36% in 2022

(with speeds rising from 2.68 to 8.18 Mbps), rural areas still suffer from inconsistent and slow internet connections, and some of the population has no access to the internet at all. This fact proves the diversity of Africa: Burundi and the Central African Republic have the lowest internet penetration, at approximately 10-11%, while Morocco ranks first with around 90%.

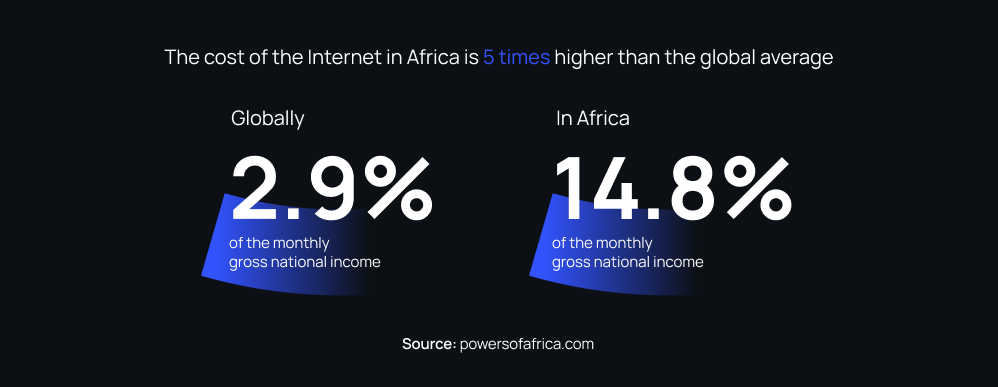

Another challenge we identified is that, even where a good connection is available, the internet is still a luxury for many African users. Globally, the cost of a broadband connection is estimated at 2.9% of monthly gross national income, while in Africa it’s 14.8%. So be prepared for a figure that is 5 times higher than the global average.

Lack of infrastructure for retail to online transition

What surprised us is that kiosk-based gambling is still widespread across the continent. It’s more than just placing bets — it’s a cultural tradition where friends and neighbours gather, socialise, and share fun and excitement. So, we realised that brands that want to ensure successful iGaming market entry in Africa must develop strategies to attract offline bettors to online platforms. This includes adapting to on-site casinos and investing in providing players with infrastructure for both online and offline betting.

And this is where many challenges arise. Africa struggles with the absence of a comprehensive digital payment infrastructure and limited access to advanced point-of-sale (POS) systems. As of 2023, only 28% of people across different African countries used digital payment services daily, and 40% used them once a week, making cash the predominant payment method. Although mobile money account ownership is growing, this progress varies between regions and countries. For example, 91% of adults own an account in Mauritius, while in Sudan, the figure is just 6%.

Predominance of feature phones

Another surprising discovery for my team was that the number of feature phone users has been either predominant or equal to that of smartphone users. Even though smartphones are becoming more widespread, this hinders user access to iGaming platforms in Africa. Therefore, it became clear to us that we needed to find a solution to make online gambling in Africa accessible to players with low-end phones as well.

These challenges might overwhelm you, and I do understand that — that is what happened to us. However, there is nothing that can’t be resolved. Our experience, combined with in-depth research on Africa, the right technology, and an agile approach, proves that it’s more than possible to enter the African iGaming market successfully.

My team and I created a 9-step checklist to guide you in developing your African iGaming market entry strategy. It is prepared based on the hard-earned insights we gained while supporting PLAYONGO’s launch — now it’s yours to use without the sweat.

Success story: PLAYONGO’s venture into the African iGaming market

When PLAYONGO, a leading player in the sports betting and casino industry, decided to replicate their success in Europe within Central Africa, they faced all the common challenges of African market penetration.

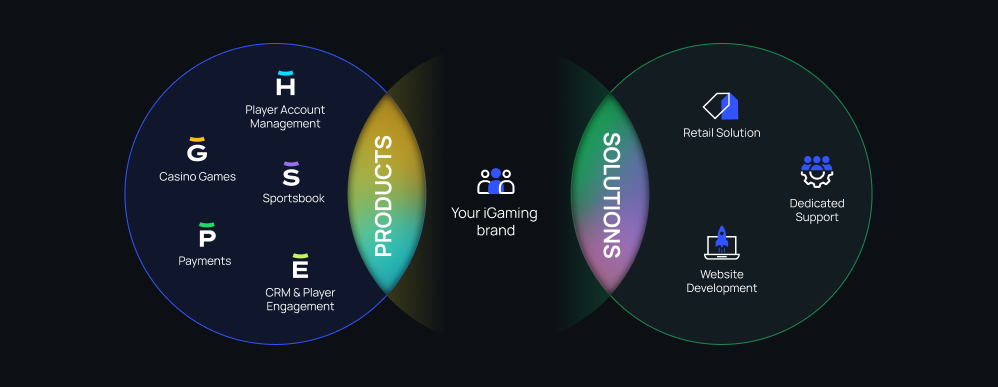

When my team and I aligned the obstacles with business goals, it became clear that the best approach we could offer was The VeliTech Turnkey Solution.

Specifically for feature phones, we introduced a USSD betting system. It allows users to place bets by dialling simple numbers on their phones, which works without internet access.

Addressing the limited access to conventional banking, our team integrated mobile money solutions. This ensured secured and convenient payments.

A buddy-to-buddy transfer feature integrated into VeliPayments allowed users to transfer funds for betting without fees, enhancing financial access for those without traditional banking options.

To resonate with the local betting habits, we added special features to our Sportsbook for Central Africa. The ACCA boost feature was developed to increase potential winnings for successful accumulator bets, while ACCA insurance was introduced to offer a safety net for nearly successful wagers. These features reflect the regional trend of seeking maximum returns from minimal stakes on high-odds bets.

Our team added seamless support and education through our customer engagement tools, making it easier for in-store bettors to try online betting.

We leveraged the VeliHorizon back-office platform to automate key shop management functions, streamlining operations and improving communication between retail and online channels.

Consequently, PLAYONGO welcomed 1.5 million new online players, resulting in a threefold increase in unique active users, a sevenfold increase in deposits and an impressive eightfold increase in GGR.

Our PLAYONGO case study has more details on how we achieved such success, so I recommend checking it out.

The road ahead: ensuring a smooth iGaming market entry in Africa with VeliTech

The casino market in Africa has a lot to offer for those willing to adapt to its unique needs and conditions. My team and I have cracked the code on how to enter the African iGaming market successfully. With thorough planning and the right tools to match country infrastructures and local culture, your entry can also be smooth and rewarding.

At VeliTech, we developed the best turnkey solution for the African iGaming market, equipped with everything you need to launch a new brand or take your existing success to a new location. Don’t wait for other online betting brands to launch an iGaming business in Africa first — secure your players today by contacting our sales team.